Money makes the world go round

The way that we use money is changing rapidly. From shells to gold coins, from bank notes to cryptocurrency.

Some of my thoughts and recollections from Scotland. I hope they will encourage you to share your own Motley Stories about the everyday things in your life, and how things change. Our ordinary lives will one day become significant and contribute to history. So, let’s share our stories, capture them in photos, and preserve them for future generations.

The saying “money makes the world go round” is a line from a song in the musical Cabaret. Although the concept remains true, the form of money has evolved over time. Credit cards were launched in 1966, but until 2000 there were still many small shops that did not accept them. However, since the Covid -19 pandemic there has been a noticeable shift, and now some shops no longer accept cash, which has surprised me.1 This change has made me contemplate the future of physical money and its significance in our lives.

How things have changed

Throughout history, there has been a necessity for a means of payment during transactions. Bartering, where goods or services are exchanged directly, has been a common method2. However, some form of physical currency has existed since ancient times.

It is interesting how the idea of worth gives an object value. Cowrie shells were used as currency as far back as the 14th century, on the western coast of Africa. In the UK, a one pound coin, worth 100 pennies, costs about 4 pennies to manufacture. I understand the logic behind coins made of valuable metals, but the oversized bank notes from the 18th century appear impractical to me, although they were only used by the wealthy.

Until 1971 Britain used a complicated currency of pounds, shillings and pence. One pound was equivalent to 20 shillings, one shilling was equal to 12 pennies, and one penny was divided into two halfpennies, or four farthings. Various coins were in circulation, such as the farthing, penny, shilling, pound, ha'penny, guinea, and crown.

The guinea coin, made of gold, was minted in Great Britain from 1663 to 1814. The gold used in the coin was sourced from the Guinea region in West Africa, hence the name. The British guinea has a notable historical and sometimes sentimental place in British culture. Until it ceased to be legal tender in 1971, luxury items were often priced in guineas (equivalent to one pound and one shilling), though the payment was made in modern currency. Even now, the prices of horses sold at auction are occasionally shown in guineas.

“But at night came his revelry: at night he closed his shutters, and made fast his doors, and drew forth his gold.”

“How the guineas shone as they came pouring out of the dark leather mouths [of the money bags].” Silas Marner by George Eliot 1861.

Luckily for me, because I am very bad at arithmetic, in order to simplify the currency, decimalisation was introduced in 1971. The previous system was replaced with pounds and pence, with one hundred pennies equaling one pound.

Of course, while the new system was easy to understand, change is hard, and there was much grumbling. Most people thought the prices were increased by more than the switch to the decimalisation system should have allowed, and there was much comparison between the ‘old money’ and the new.

It is hard when you are used to forming an idea in your head of what a shilling should buy, to start thinking in pounds and pence. A penn'orth (a penny worth ) of sweets became a thing of the past. Though the saying “That's my two penn’orth” is still used when you express an opinion. Pennies are rarely used these days, except when shops sell something at £19.99 rather than just saying £20, which I find very annoying.

Money in my life

I agree with the sentiments expressed by ABBA’s song, “money, money, money, must be funny, in a rich man’s life”. But while I have never been rich, I have never been poor either. I have mostly had a modest income, but I acknowledge my privilege compared to so many who live in abject poverty. I am very grateful for all I have, although it would be wonderful to experience “a rich man’s life”!

In 1971 my grandparents managed a Post Office, and during decimalisation they received bags of new, shiny money. I was given the first 50p coin in my village, which was also double my pocket money, so I was very happy.

In some ways I miss handling physical money. Although it required thinking ahead to make a trip to the bank to ensure you had enough money, it was easier to budget. If you didn’t have the money in your purse, you couldn’t spend it. Of course, there was always the option of using a chequebook3, but they are becoming a thing of the past. The last cheque I wrote was in 2011. Do cheque guarantee cards even exist nowadays?

A friend of mine once lamented, “how can I be broke when I still have so many cheques left?”.

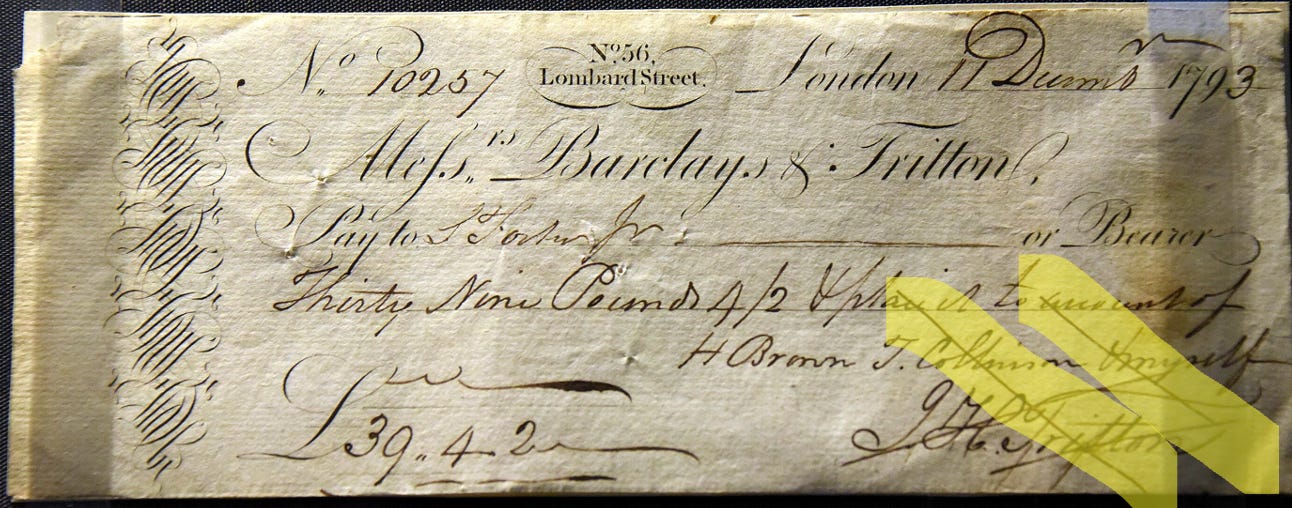

A Barclays & Co. cheque for 39 pounds, 4 shillings, and 2 pence, issued in London by Messrs Barclay and Tritton, 1793, on display at the British Museum in London. It is a crossed cheque (highlighted below), with two parallel lines drawn across it, that indicates the money can only be deposited into a bank account.

In the past getting into debt required a face-to-face conversation with a bank manager, who was a real person, rather than an automated chatbot. Money lenders have always existed, but nowadays it is much simpler to obtain money by using a credit card, resulting in immediate debt with awful consequences. Nowadays, money management and debt appear to be controlled by impersonal, automated IT systems, making it challenging to navigate.

I don’t miss coins, because they are heavy. My husband used to keep his coins in his trouser pockets, which I often had to replace when they wore through. Purses (wallets) are never designed properly. My grandmother had a purse that you had to turn the opposite way from the coin pocket to take out the bank notes. As expected, she often forgot to close the coin pocket, and all her coins would spill onto the shop floor.

When my daughter was a child, she had several ceramic piggy banks. I've always wondered why pigs are associated with saving money. Some of the piggy banks had a slot underneath for easy access to the money, while others required smashing to retrieve the coins. The excitement of expecting a stash of pound coins in the piggy bank, often turned into disappointment when the reality was just a pile of small coins (that’s where all the pennies went to), of little value.

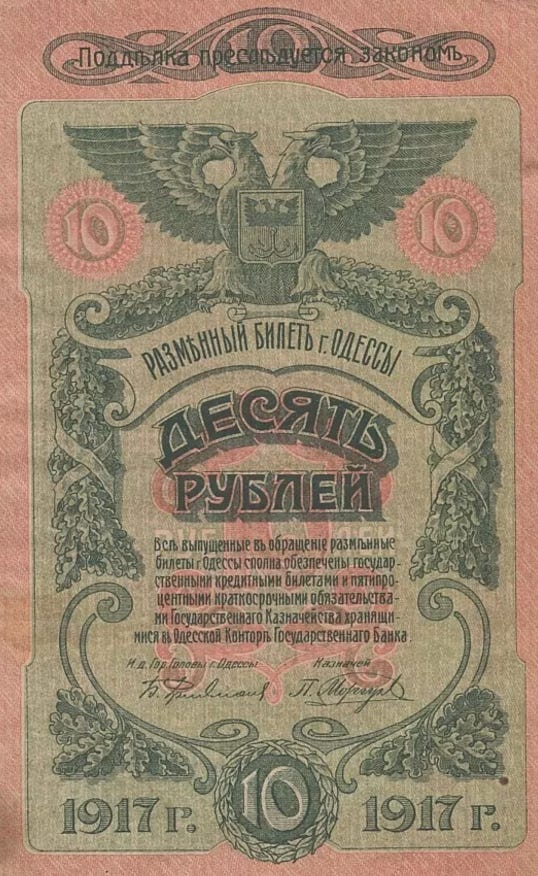

We are fortunate to live in a relatively stable economy in the UK, unlike other countries where there has been a catastrophic currency devaluation. My husband’s grandfather was a wealthy man, but when he fled Russia during the 1917 revolution, he could only take bank notes with him. He carried a fortune but, along with his fellow countrymen, by the time they arrived in Europe and tried to cash their bank notes, they were not worth the price of the paper they were printed on. When my husband cleared his parent’s house, he found a box of beautiful but worthless Tsarist banknotes.

I make an effort to stay current, but I must admit that cryptocurrency, bitcoins and the like leave me confused. It's possible that upcoming generations may never handle physical currency. Children will receive ‘pocket money’ (allowances) but have nothing to put in their pockets. Instead, they'll face the challenge of managing their allowance without tangible money to count, and have to justify each purchase, now listed on a credit card statement, to their parents.

Nobody will ever again experience the delight of discovering a forgotten five pound note in a pocket, that can be spent on absolutely anything, without anyone knowing.

Do you have a story or memory about money?

Or join our weekly Motley talk and add photos & comments

Other viewpoints

The History of Money by Jack Weatherford. Cultural anthropologist Jack Weatherford’s book tracing our relationship with money, from primitive man’s cowrie shells to the electronic cash card, from the markets of Timbuktu to the New York Stock Exchange.

Why 'Piggy Bank'? Why not lamb, cow or donkey bank? Letters to the editor of the Guardian newspaper, with various theories.

Bank branch closures. According to Which! magazine, banks and building societies have closed 6,228 branches in the UK since January 2015, at a rate of around 53 each month. This represents 63% of the branches that were open at the start of 2015.

The Russian Refugee Crisis of the 1920s. The Russian civil war led to the displacement of over one million people, including countless children. This is a short blog about the tragedy.

Cryptocurrency explained by Wikipedia. “A cryptocurrency, crypto-currency, or colloquially, crypto, is a digital currency designed to work through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it.”

I have included links to articles that I hope you will find interesting. I do not have any financial or business affiliations with these websites. Access to these websites is free, but access may only be available in the UK. Please let me know if any of the links are not working.

Are you overwhelmed with photos, and not sure how to sort or use them? Coming soon - the Motley Stories Community.

I will soon be launching a series of guides for the Motley Stories Community, to offer advice on how to manage and organise your photos. Additionally, I will provide suggestions for using photos, journals, and notes to easily document and preserve your stories and experiences; including how to incorporate these elements into your memoirs, photo books, and other projects. Access to the Motley Stories Community will be available to paid subscribers. More information soon.

Cash was used for only 14% of all payments in the UK in 2022, according to data from the trade body UK Finance.

Van Gogh exchanged paintings in return for food, or drawing and painting supplies.

Chequebook is the UK spelling of checkbook (USA).

"Money makes the world go round" is an idea that Paul Glover decided to test in Ithaca, NY. Ithacahours is a local currency in which bills are in denominations of hours. Time is money, right? So a massage therapist offers a one-hour session in exchange for one Ithacahour. That bill can be used to exchange for local goods and services including produce and piano lessons, dog training or dental cleaning. Alternatives Federal Credit Union kept track of how the currency circulated in the city of Ithaca. All in an effort to see how currency could circulate in the local economy. Think globally, act locally was more than a bumper sticker.

This piece beautifully captures the sentimental and practical sides of money. I completely relate to the joy of finding a forgotten fiver—pure magic! The children in my class still get their pocket money in cash...phew.